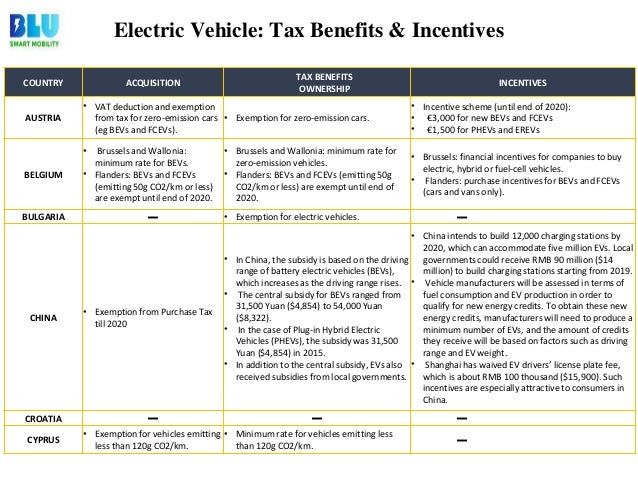

Electric Car Tax Benefits. Since the global realization of the negative effect of traditional industrial technologies on environment and climate, sincere development has occurred in the field of innovative, environmental friendly technologies. The government is phasing out the electric vehicle tax credits as sales increase, on the theory that the high initial cost of adding new technology to a vehicle All other makers are trailing far behind in plug-in car sales.

Find out whether you or your employee need to pay tax or National Insurance for charging an electric car.

How Much Is the Electric Vehicle Tax Credit?

The Treasury has confirmed this week that company car drivers who choose an emissions-free electric fleet model will pay no benefit-in-kind (BIK) tax for the year as part of new efforts to encourage motorists to switch to. When an employee receives a vehicle for personal use from the company, this is classed as a 'perk', which is taxable. The savings are especially significant for company car drivers paying a.